WEDNESDAY, SEPTEMBER 8, 2021

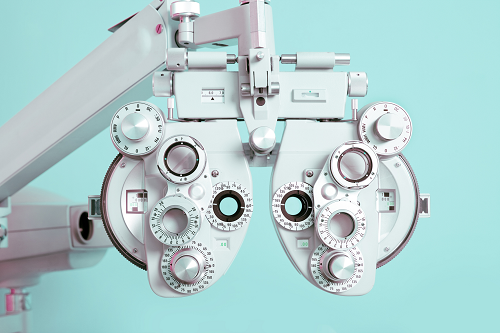

Purchasing vision insurance—either as a company purchasing a plan for employees or as an individual buying for your own needs—can seem like a difficult process. Although some traditional health insurance plans provide vision coverage, most vision policies are standalone forms of insurance, meaning you'll need to purchase it alongside your health insurance. But it's worth it! Doctors recommend having an eye exam at least once each year. The cost of prescription glasses, contacts and sunglasses can be very high as well, making these policies worthwhile. Before you buy coverage though, it's important to know what to look for in these plans.

Before you buy any type of vision insurance, consider these three components. You'll want to select the policies that work for your unique needs in each of these areas.

#1: Care Providers

Many vision policies specifically list which eye doctors you can visit and still be covered. The more flexibility present, the easier it will be for you to find an eye doctor you like, who provides the services you need and is located near you. Don't assume a provider is available in your area until you've looked at this carefully. You want as much access to a network of eye care providers as possible.

#2: Prescription Coverage Levels

In nearly all cases, you will want a plan that covers various needs. This includes eye exams that provide full screenings. You also want a policy that can cover (as much as possible) of the cost of glasses and prescriptions. Many plans place a limit on how much can be spent on the purchase of these products annually per individual.

#3: Types of Care Provided

Look further at the plans to determine what they specifically offer in key target areas. Care may be necessary for optometrists and ophthalmologists. In some cases, you'll need refractive surgeons that can provide you with LASIK procedures. In other cases, especially as you get older, you'll benefit from vision insurance that offers aid for glaucoma treatments and cataracts.

With this information, determine which policy can offer you the best level of coverage based on your needs right now and into the future. You'll want to know where eye doctors are located, what services are covered and most importantly, how much of your costs are covered by the plan.

Do you have the right coverage? Call Lakenan at for more information on vision insurance.

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|